The government is likely to allow businesses to use their Permanent Account Number (PAN) for single-window clearance of all taxes and duties, a move that will help cut down on the time and cost associated with doing business in India.

The proposal, which is being finalised by the Revenue Department, will be put up for inter-ministerial consultation soon. Once cleared, businesses will be able to obtain a PAN-based registration number that can be used for all their tax and duty payments.

This will replace the current system wherein businesses have to obtain separate registration numbers for each type of tax or duty they are liable for. The PAN-based registration number will also be linked to the business’s bank account, making it easier to track all transactions.

Currently, businesses have to maintain multiple bank accounts – one each for GST, income tax, import duties etc – leading to increased costs and complexity. The new system is expected to simplify this process and lead to greater compliance as well.

- India’s Cricket Fervor Hits Fever Pitch as World Cup Final Nears

- India Takes on Australia in the 2023 ICC Men’s Cricket World Cup Final

- Pharma Jobs: AIIMS Raipur Announces Direct Recruitment for 31 Pharmacist and Dispensing Attendant Positions; Applications Open till July 31, 2023

- Got Utkarsh Small Finance Bank IPO? Find Out NOW! Simple Steps to Check Your Allotment Status!

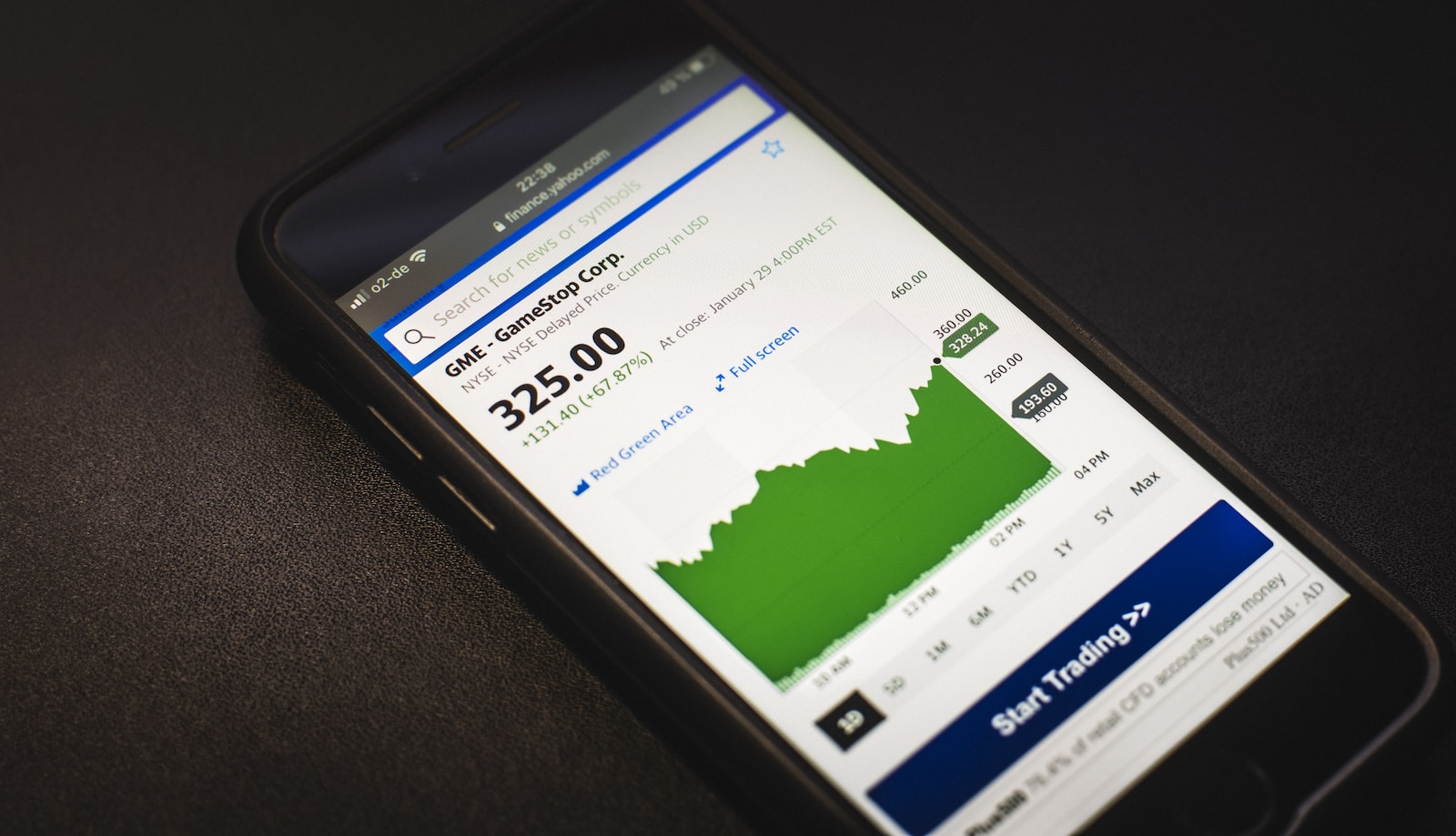

- Voltas and Zee Entertainment Lead as Volume Toppers in Stock Market; See High Trading Activity

- Stock Market Live- Significant Gains in Stock Market Led by Sahara Housing and Tips Industries; Shares Surge by 20%